As high global oil prices, spurred by Russia’s invasion of Ukraine, drive up the price of fuel and many other things too, there’s pressure on Australian politicians to offer some relief.

There are calls for the federal government to cut the fuel excise (currently 44.2 cents a litre) and for state governments to also respond.

The Tasmanian government is making bus services free for five weeks to offset cost of living increases. In New Zealand the government has halved fares.

But free public transport risks worsening social inequalities in Australian cities by benefiting wealthier households over the less affluent. From an overall welfare perspective, it’s economically regressive policy, contradicting the progressive positioning usually favoured by its proponents.

Mapping transport networks

On average, about 80% of travel in Australian cities is undertaken by private vehicles, but car dependence differs significantly by area.

People who live in inner and middle suburbs and work in the CBD use public transport at much higher rates than residents and workers in outer and fringe suburban areas.

This is principally because public transport services are generally much better in inner and middle suburbs, and serve CBD-focused journeys well. The further a worker is located from the CBD, the more they are likely to be forced to rely on private automobiles and travel to dispersed workplaces.

Public transport service quality

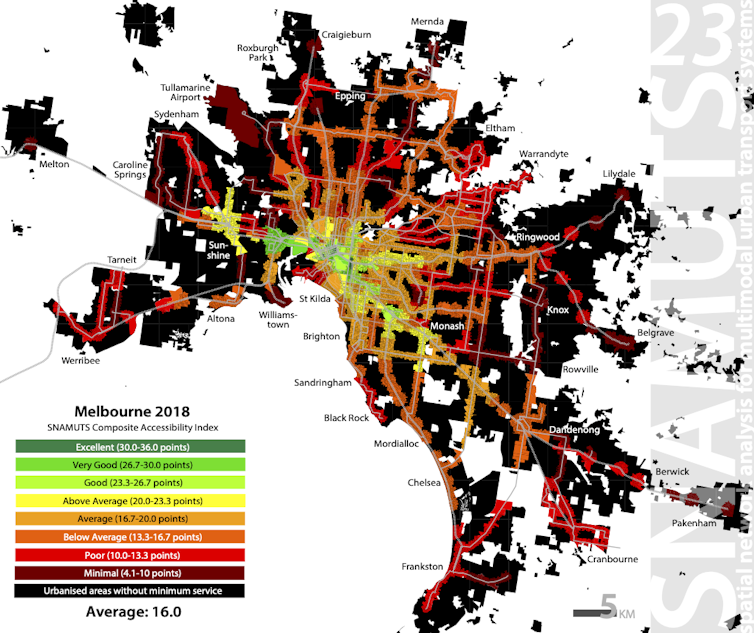

The first map shows Melbourne’s public transport network service quality. In the green areas, services are frequent and connected; in the black areas, they are residual.

Vulnerability to fuel price increases

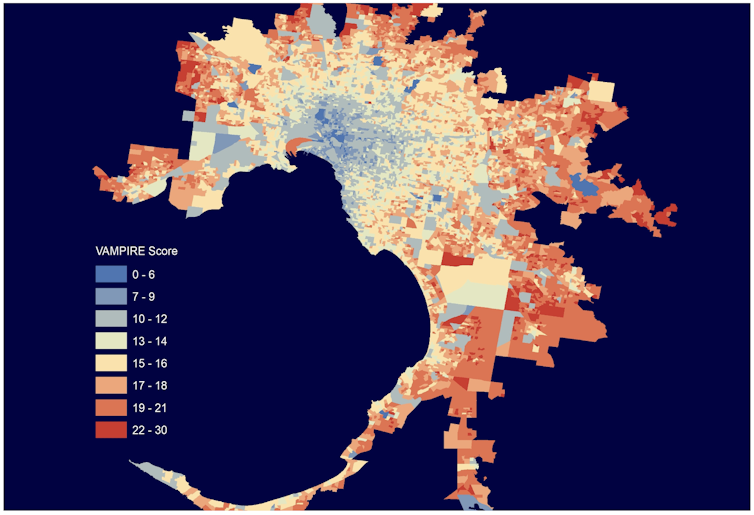

The second map shows the economic vulnerability of households to higher fuel prices as well as inflation and mortgage interest rate rises. The areas of greatest vulnerability almost exactly match the areas with poor public transport service.

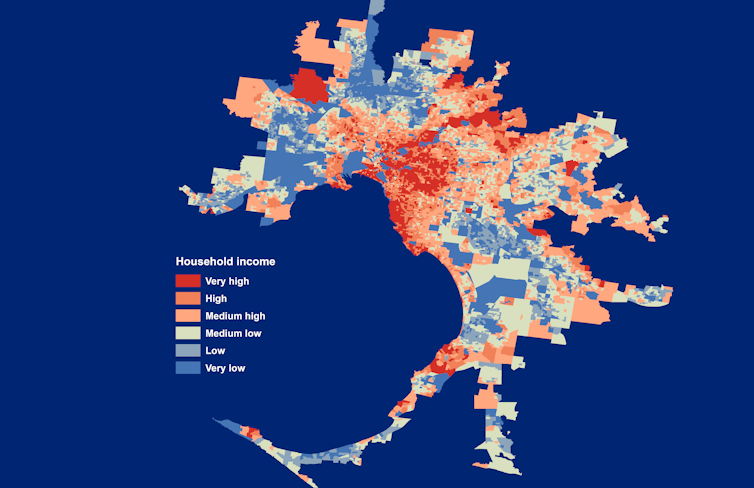

The third map shows the distribution of Melbourne households by weekly income. There are variations but poorer regions tend to poorly serviced by public transport.

Occupation, income and transport costs

These pattern of households in poorer areas being more dependent on private transport generally apply in every major Australian city (with some variance).

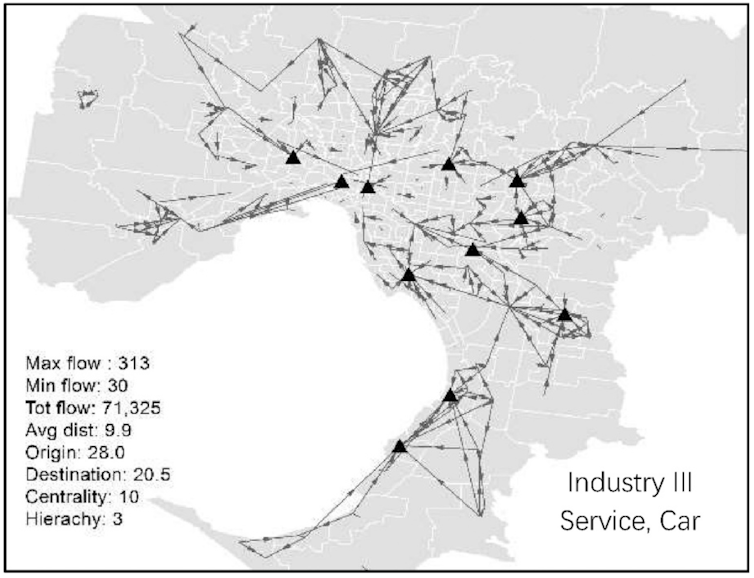

Research we’ve done using census data shows the commuting cost burden – the proportion of income spent on transport – for the average service worker in the retail and hospitality sectors is double that of a professional in the scientific and financial sectors.

The following map shows the commuting patterns for retail and hospitality workers who travel by car. These are highly dispersed, and largely in the areas poorly served by public transport. Making inadequate public transport free won’t help them much.

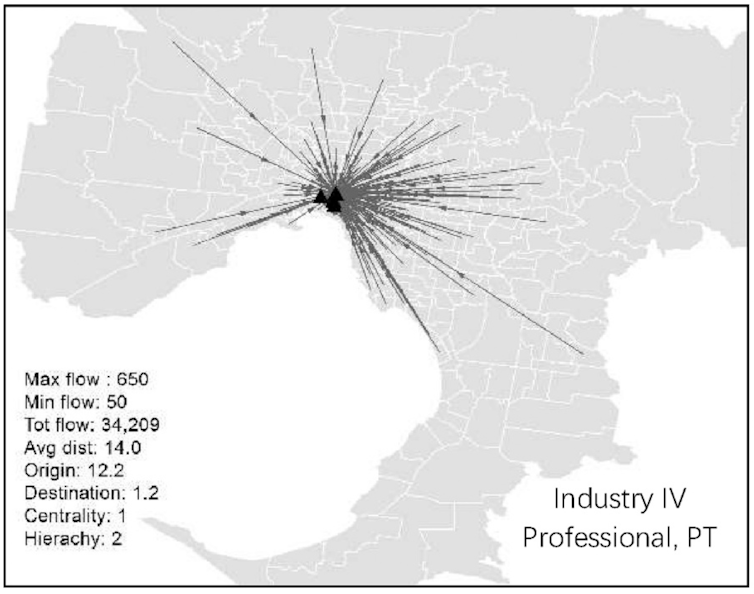

Now, by contrast, consider the commuting patterns for professional scientific and financial workers commuting by public transport. Free public transport will benefit them greatly.

What needs to be done

So what what would be a less regressive response to higher fuel prices?

In the short term the best response is income assistance, targeted to those who need it most. In the longer term the best response is to reduce dependence on fossil fuels and increase household resilience through greater wage and income equity.

Making public transport cheaper is less important than providing better and more equitably distributed services. This could be funded by cancelling road projects that entrench automobile dependence – such as Melbourne’s A$16 billion North East Link toll tunnel project – and spending the money on outer suburban public transport upgrades.

Another change would be to ensure new suburbs are built with good public transport services at the outset. Currently, plans for new growth areas don’t require an accompanying integrated public transport network plan and rollout program. This should be mandatory so there’s public transport in new suburbs from the outset.

Measures could also include incentives to accelerate the transition to electric vehicles, but these also require care to ensure subsidies do not just benefit wealthier purchasers who can afford a new car while those on lower income driving older cars miss out.

While there’s a push now to slash the fuel excise duty, there’s a long term case for actually increasing it, based on international evidence showing higher fuel taxes do shift travel behaviour away from cars and reduce reliance on fossil fuels.

A generalised carbon price could have a similar affect and help drive down emissions. However, the regressive aspects of increased taxation would also need to be addressed through income measures and ensuring the extra revenue is used to improve public transport in oil-vulnerable suburbs.

This article is republished from The Conversation under a Creative Commons license. Read the original article.